Introduction

What is 3DSecure ?

The 3DSecure process adds a security layer to an online purchase: the buyer will usually validate his payment by entering a one-time passcode provided by their bank via text messsage. Other methods also exist. When a transaction is authenticated with 3DSecure, the liability in case of a subsequent chargeback is borne by the issuing bank. This is refered to as the principle of liability shift.

Payline holds Visa and Masterdard International (MCI) 3DSecure certifications.

Subscription

The merchant gets a 3DSecure Distance Selling contract with their bank and sends the details to Payline.

Payline registers the 3DSecure contrat with Visa and MCI then activates the contracts. Allow up to ten working days for activation.

Prerequisites for using Payline payment solution

The 3DSecure solution in Direct interface mode ensures the secure transfer of sensitive data and processes authentication and authorization requests.

Integration points :

- verifyEnrollment is required to provide authentication and doAuthorization to perform the authorization;

- get the result of the transaction with getTransactionDetails.

You must check the service access key and configure the SOAP UI.

3D-Secure in Direct Interface mode with a payment

The following steps present verifyEnrollment and doAuthorization web services for realizing 3DSecure transactions using the Direct interface.

Step 1 - verifyEnrollment

This first call is to verify the eligibility of the card to a 3DSecure authentication, and therefore to know if the cardholder is registered with a VISA or Mastercard Directory Server. This is done with the verifyEnrollment web service.

Example of a request and response for the verifyEnrollment web service :

verifyEnrollmentRequest (VEReq) | verifyEnrollmentResponse (VERes) |

|---|---|

<impl:verifyEnrollmentRequest> | <verifyEnrollmentResponse> <termUrlName>TermUrl</termUrlName> |

Once enrolment has been confirmed, an authentication call to the ACS server can be initiated. Information received from the verifyEnrollmentResponse must be sent to the authentication server.

Sending information

To send this information :

- in POST : create an HTML form,

- in GET : create a link.

POST : The data information will be sent to the authentication server via the form below.

The field names and values are dynamically retrieved from the verifyEnrollmentResponse :

Payment session:

mdFieldName = MD

mdFieldValue = 1Fz9nEnAZJNn8NvXEKDT

Authentication request:

pareqFieldName = PaReq

pareqFieldValue = eJxVkdtuwjAMhl+l4gGaA...

Authentication adress server. This address must retrieve a form sent in POST.

termUrlName = TermUrl

termUrlValue = https://acs.modirum.com/mdpayacs.php

Sample HTML form to perform a test on your server:

HTML form |

|---|

<form name="downloadForm" action="https://acs.modirum.com/mdpayacs/pareq" method="POST"> |

Receipt of information returned during authentication

The authentication server sends its message to the URL entered in the TermURL parameter (sent in the previous form). In the response form, two fields must be retrieved to continue the transaction in 3DSecure mode:

- The MD field: always the same field allowing the follow-up of the session

- the Payer Authentication Response (PaRes) field: an encrypted string containing the response of the authentication server. The value of the PaRes field will validate or not the transaction as a 3DSecure transaction.

These two fields are retrieved and allow to complete the doAuthorizationRequest in 3DSecure mode.

Sample script (here written in PHP) to retrieve the response to authentication :Script PHP : receive_form.php |

|---|

<?php |

Note: This script must be placed on a started web server and in a folder corresponding to the address sent via the TermURL field.

Example: if the server is local it is quite possible to put as value:

TermURL = http://127.0.0.1/3DSecure/receive_form.php

Step 2 : doAuthorizathion with3D Secure settings

The doAuthorization service allows you to perform the transaction with the 3DSecure parameters.

The parameters provided : md / pares permit to check user authentication and thus the user identity before carrying out the transaction.

If the parameters are correct, the transaction is carried out as authorization request.

doAuthorizationRequest | doAuthorizationResponse |

<impl:doAuthorizationRequest> | <doAuthorizationResponse> |

Back Office

Menu 'Technical follow-up of webservice calls' to find the call of the web service verifyEnrollment allows to see the details of the verifyEnrollment.

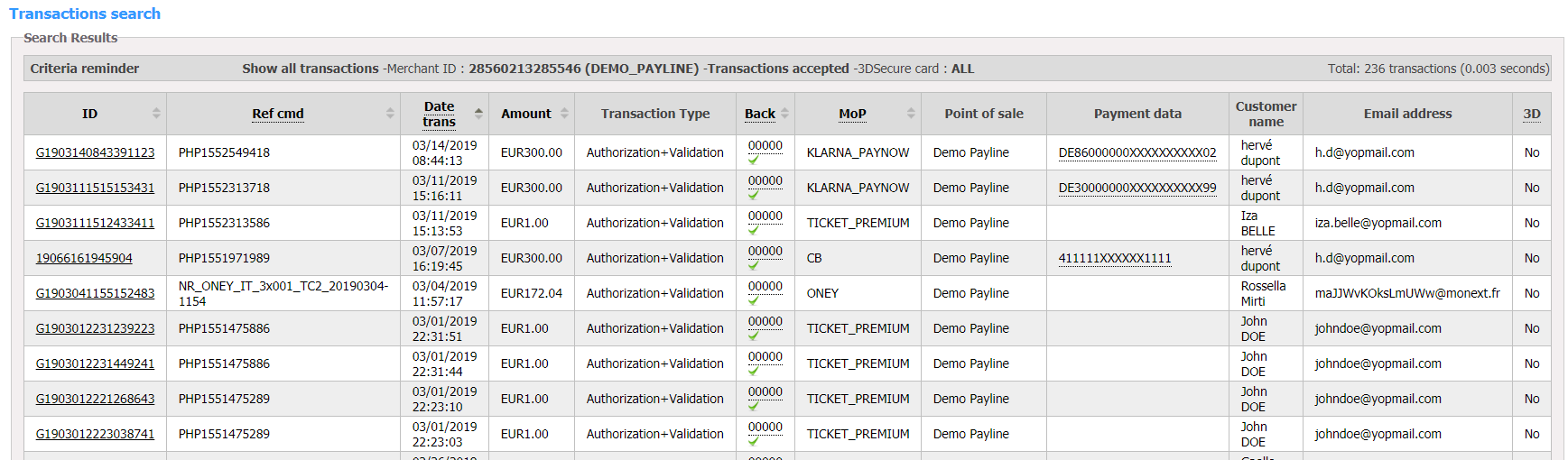

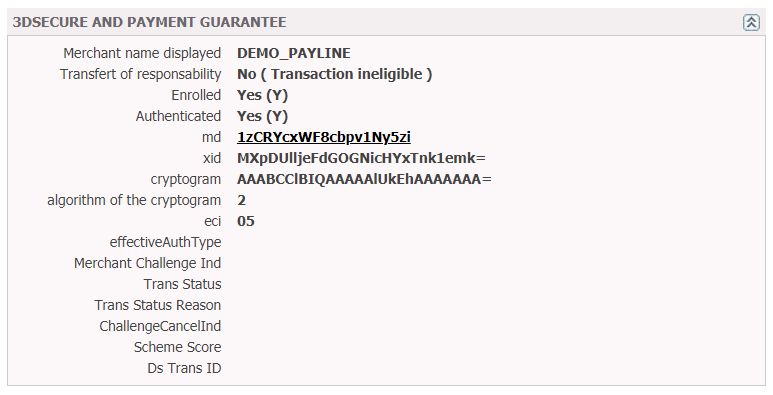

The result of the 3DSecure transaction is then visible in the Payline Administration Center: on the results of a search and in the detail of the transaction 3DSecure tab.

Screen searches for transactions:

3DSecure transaction Details:

3D Secure payment scheme

- The consumer validates his cart shopping then the merchant prepares web page to where will be filled the payment data.

A VEReq (Verification Enrollment Request) message allows access to Directory Server to verify cart registration in the directory containing cards declared "enlisted" 3-D Secure and provide ACS URL.

Verification enrollment response containing authentication result, that will be returned to Merchand Plug-in (MPI) to manage the dialogue with Directory and ACS to allow the buyer to authenticate. - The merchant redirects the consumer to ACS URL for authentication.

The request "PAReq" (Payer authentication request) allows access to bank ACS to trigger the authentication phase.

The response "PARes" (Pay authentication response), containing the authentication result of cardholder will be transmitted to the merchant. - The merchant can trigger a request for authorization and payment validation by calling service doAuthorizationRequest.

- The merchant retrieves details transaction by calling service getTransactionDetails.