Content

More information

How to configure your account ?

You need to contact your partner account manager to obtain the necessary information to configure your test and production account on Payline (account login and password).

In order to create the PAYLIB payment method on Payline, in test and in production, go to the backoffice in the "Configuration" tab then "Your payment methods". A search screen appears, click on the "New payment method" button.

Payment method creation screen 1/2:

Select your point of sale then the payment method type "PAYLIB".

Then click on the "Next" button.

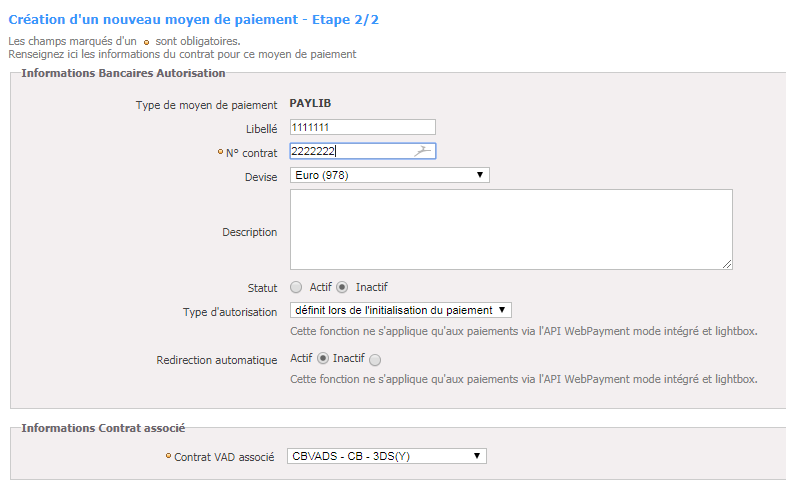

Payment method creation screen 2/2:

Enter a description, a contract number of your choice then select your currency. Click on the “Active” status and fill in the associated acquirer contract. You must perform test transactions to validate proper operation in production.

The acquirer contract must be 3D-Secure but the 3DS option must not be activated on Payline, it is Paylib that triggers the 3D Secure.

View Paylib payment pages

Displaying the PAYLIB payment pages simply requires contacting the doWebPayment web service. This web service returns to your server the url to which you must redirect your customer so that he can make his payment.

So for those of you who use Payline to accept payments by credit card, the display of the PAYLIB payment method is achieved simply by having activated your payment method.

To select the payment methode to be displayed to the consumer, you must add to the value of the “selectedContractNumber” field the number you entered when configuring the payment method.

You must fill in the “contractNumber” field with the value that you entered when configuring the payment method.

Payline informs you of the result of a payment via the return code of the getWebPaymentDetails and getTransactionDetails messages.

How to offer Paylib payment to yours customers ?

Once the payment method is activated, you must implement an integration with PAYLINE web service calls in web mode: doWebpayment and getWebPaymentDetails

The available payment features are described below.

Payment Validation

The transaction is sent automatically the same day.

This payment requires the following parameters:

- Payment mode = CPT

- Payment fonction = Author+Capture

- Payment action = 101

Deferred payment with automatic validation

The transaction is sent for financing with a deferral of n days (maximum D + 6).

This payment requires the following parameters:

- Payment mode = DIF

- Payment fonction = Author+Capture

- Payment action = 101

- Differed action = Date on the wished validation date

Payment with validation

The transaction is sent for financing only if you validate the payment. If the payment is not validated, it changes to expired status and can no longer be funded. You have 30 days to validate. The transaction is not guaranteed until it is validated.

This payment requires the following parameters :

- Payment mode = CPT

- Payment fonction = Author

- Payment action = 100

Other features

The following functions are available via the Payline back office and webservice API:

- Total or partial validation of a payment.

- Cancellation of a payment.

- Full or partial refund of a payment.

Paylib One-Click

One-Click Paylib should make it possible to speed up payment stages while maintaining the payment guarantee.

The buyer must request to register the Paylib wallet used during a standard payment, and then secondly, to pay with one click by referencing the registered wallet.

Paylib realizes the payment in one click using the preferred card of the referenced wallet.

The preferential card is defined or modified by the holder of Paylib wallet by connecting to his online banking application.

The management of preferential card is carried out outside of any payment process.

Available functions

- Paylib allows you to renew the authorization using the doReAuthorization web service.

- The validation is performed either from the backoffice, or from the doCapture web service, or from the batch interface.

- The refund / cancellation is made either from the backoffice or from the doRefund or doReset web service.

- The hidden PAN and card expiration date are updated as needed after each Paylib One-Click payment.

- Payment with Paylib allows the tokenized PAN of the card used for payment to be sent to the merchant (getPaymentStatus).

- Recurring or Instant payment is not possible with a Paylib Wallet type card.

The user is identified automatically via an association between a technical Wallet identifier provided by Paylib and a buyer identifier provided by the merchant.

Configuration

To use Paylib one-click payments, the merchant must configure at the level of his points of sale :

- Commercial offer authorizes Paylib payments.

- The reference banking contracts are 3DS.

- Do not activate 3DS in Payline.

- Sharing wallets.

- Registration of payment data in the Payline wallet.

- The conditions for recording payment data.

Integration

The consumer must realize a first payment and register his card in the wallet using the doWebpayment web service and providing an order reference, the OK and KO return URLs, the URL to allow Payline to notify the end of the order, the data related to the order, delivery, holder, payment method, etc.

If the cardholder is authenticated and the card is present, Payline records the data and the identification token of the Paylib wallet.

For the second payment, if the merchant provides the reference of this wallet in a doWebpayment payment request with a wallet containing a Paylib type card, then Payline offers Paylib payment in one click.

As for all payments made with by wallet, the getWebPaymentDetails returns the VAD contract number associated with the Paylib wallet. To retrieve information on the type of wallet used during the transaction, use the "externalWalletType" field and the "externalWalletContractNumber" field at the output of the getWebPaymentDetails service.

Paylib authenticates wallet holders in two different ways. The method used is defined by the issuing bank :

- By sending an OTP SMS that the holder must return (M1 method).

- Via the mobile application (M2 method).

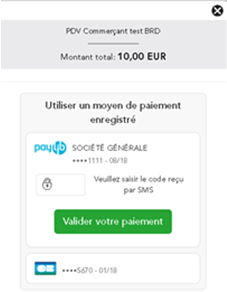

Method 1: with password not SMS

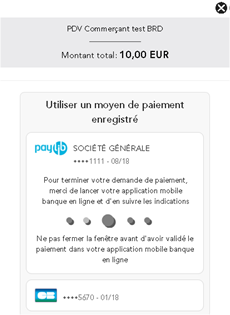

Méthod 2: with validation on the smartphone in-app

You must contact support and ask them to create a PAYLIB account from your existing banking contracts.

One-click cancellation of a Paylib payment

A buyer who chooses a one-click Paylib payment can abandon this payment method and choose another before the authentication step.

The standard customization of payment pages requires the buyer to cancel the Paylib payment with one click in progress before changing the payment method.

Personalization by Widget allows the change of payment method without explicitly requesting the cancellation of the Paylib one-click payment.

Processing of the brand choice function

The Paylib payment method is not subject to the European regulation known as the choice of brand.

Payline forwards authorization requests to the SAA requesting processing through the CB network.

Return codes

Payline informs you of the result of a payment via the return code of the getWebPaymentDetails and getTransactionDetails messages.

When the payment is accepted, Payline returns the return code to the value "00000". For a refused payment, the code varies according to the reason for refusal (For example: 04xxx for a suspected fraud).