Contenu

More informations

Overview

This new service allows you to reduce PCI DSS constraints by replacing buyer payment data with a unique token, thus avoiding the manipulation of sensitive data.

The Token Requestor creates a new token specific to each card and sends it to Monext to be used instead of the payment data.

In addition to enhanced security, expired or compromised payment tokens can be updated in the background by the financial institution concerned, eliminating one of the main friction points for both you and your buyers.

This eliminates the risk of a buyer forgetting to update their data when a payment deadline arrives, or having a payment declined due to outdated information.

By reducing your authorization rejections, you will increase your order conversion rate.

Benefits

- Improve the acceptance rate of a transaction

- Unique security cryptogram (TAVV) created by the network for each transaction.

- Improved confidence from issuers: transaction "certified" by the network.

- Provide consumers with a better shopping experience

- Token automatically updated at each change (expiry, opposition, renewal, ...).

- Provision of additional specific information (issuing bank, card visual, expiry date, etc.).

- Significantly increase the security of consumer data

- Unique token that cannot be used by another merchant.

- The actual buyer card data will only be known by card network.

Prerequisites

Use of the Visa Token Service or Mastercard Digital Enablement Service functionality is available if all merchant acquirers are enrolled with the service and use the CB2A 1.6.1 protocol.

You must have the "Scheme Tokenisation" option: please contact the Payline support team to update your subscription.

This feature will be available after obtaining a "Token Requestor Identifier" provided by Visa or Mastercard. See the configuration to obtain an identifier.

The available functions

This service allows you to tokenise a payment card when registering the card in a wallet.

Then you can use the e-wallet features to make payments with this service.

You can also tokenize all the cards already tokenized in token.

For this you need to contact our support to make the migration.

Contact our support team.

The payment

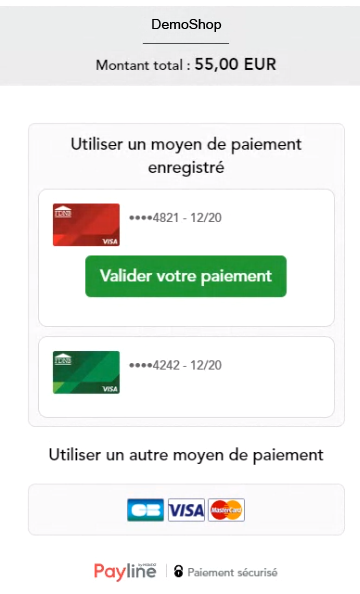

It is essential to use e-wallets to make tokenised payments.

- The first transaction will be carried out to check the eligibility of the card, then it will be registered in a wallet and the card will be tokenised.

The buyer must accept the card registration during this first payment. - For subsequent payments, the token will be used for payments without the buyer's intervention:

The buyer is not involved in this tokenisation.

The wallet will be displayed with the buyer's hidden card, but the payment will be made with the token.

Brand selection is required to tokenise co-branded VISA and MASTERCARD cards.

Cards selected on the CB network will not be tokenised.