Content

More information

What is Paylib ?

Paylib is payment method using electronic wallets (also called wallet) offered by the consortium of ARKEA, CA, BNPP, SG, LBP, Hello Bank, Boursorama, BP, Caisse d'Epargne, CM and CIC.

Paylib integrates Visa, Mastercard and CB cards.

Its aims to simplify and reliable online payment :

- The Internet user no longer needs to enter card information (PAN, expiration date, CVC).

- Paylib optimizes cardholder authentication by adapting it according to the risk calculated for each transaction.

More information : https://www.paylib.fr/

Available functions

In summary, this payment method :

- allows payments on order,

- allows payment on shipment,

- allows you to make deferred payments.

- allows the total or partial validation of payment, the cancellation of payment

- allows the total or partial refund of payment to be carried out via the Payline back office.

Synchronous / asynchronous processing

Payment processing is carried out in asynchronous mode.

What is the user experience ?

The user experience of a payment comes down to:

- the shopper validate his order and initiate payment (merchant site).

- he chooses the Paylib (Payline) payment method.

- he is put on hold for connection to the Paylib wallet (Payline).

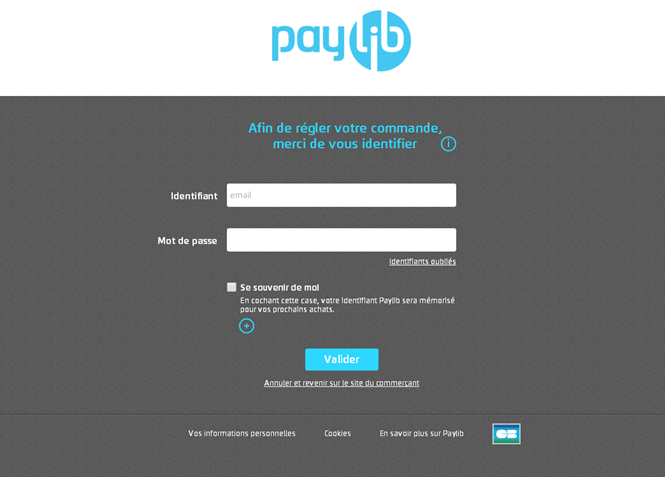

- he connects to Paylib

- he chooses his card

- he authenticates (Paylib).

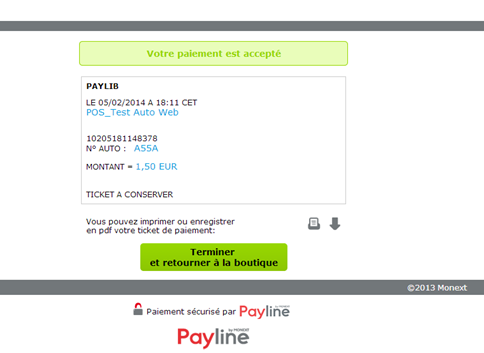

- he consults the ticket (Payline).

- he returns to the web merchant (website).

The figure above gives the sequencing of the pages. Note that pages 2 and 7 are optional

Payment flow of a web payment

On your e-commerce site, your customer clicks on the “pay” button to proceed to payment for their order.

Your site contacts Payline to complete a transaction.

Payline returns a session token and the URL to use to redirect your customer to the Payline web pages.

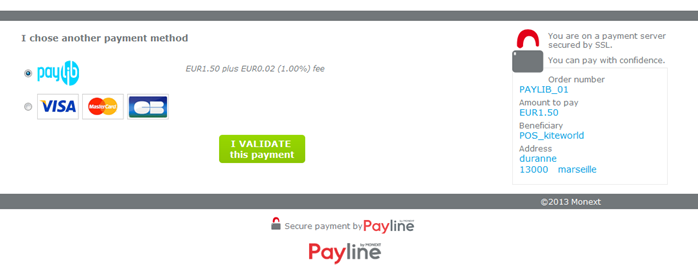

Step 1: Choice of payment method

Step 2 : Redirection to the PAYLIB authentication page

Step 3 : Validation of the transaction from PAYLIB

Step 4 : Payment receipt then redirection to the merchant site

Payment with PAYLIB with declared smartphone

Payment by mobile via PAYLIB requires installing the PAYLIB application and registering your account on it.

Once the PAYLIB payment method has been selected on the merchant site, the user is redirected to his PAYLIB application in order to authenticate and finalize your purchases.

Step 1 : Pay for purchases

Step 2 : PAYLIB application management interface

Step 3 :Retrieving payment information

What reporting is available ?

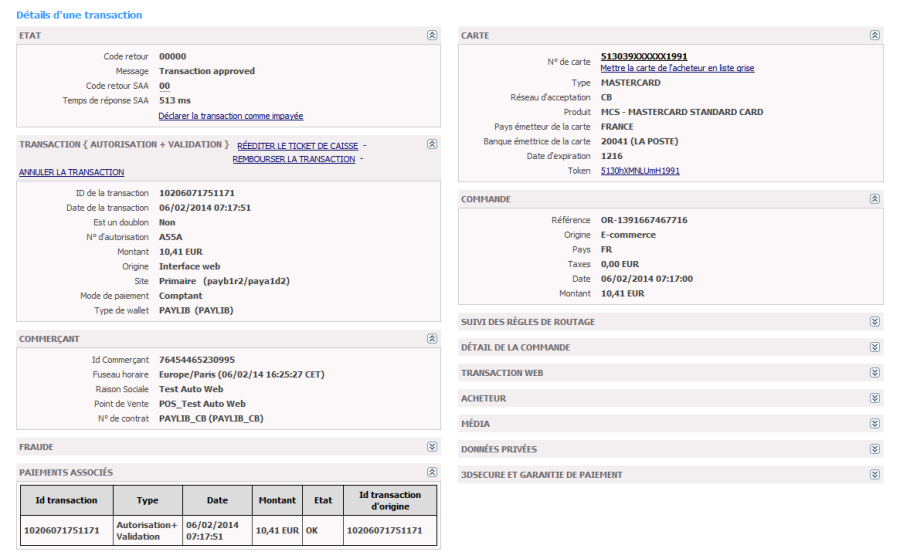

Monitoring of transactions from the Payline back office

On the back office you can view the transaction realized with the PAYLIB payment method.

Reporting file

Payline integrates the PAYLIB reporting files, which allows monitoring in the administration center of PAYLIB transactions and being able to find this information in the consolidated reporting file.

This file can be:

- Either generated manually via the administration center. In the Payment transactions menu, click Export your transactions.

- Either generated automatically daily and sent by a secure flow.